Navigating Insurance Coverage for Semaglutide

As the prevalence of obesity and related health issues continues to rise, medications like Semaglutide have gained significant attention for their effectiveness in weight management. Semaglutide, originally developed for type 2 diabetes treatment, has been found to aid weight loss, leading to its approval by various health organizations for this purpose. However, the complexities surrounding insurance coverage for such medications can pose challenges for patients seeking effective treatment options. This article aims to explore the insurance landscape for Semaglutide, including its coverage, costs, and implications for patients in the UK.

Understanding Semaglutide and Its Uses

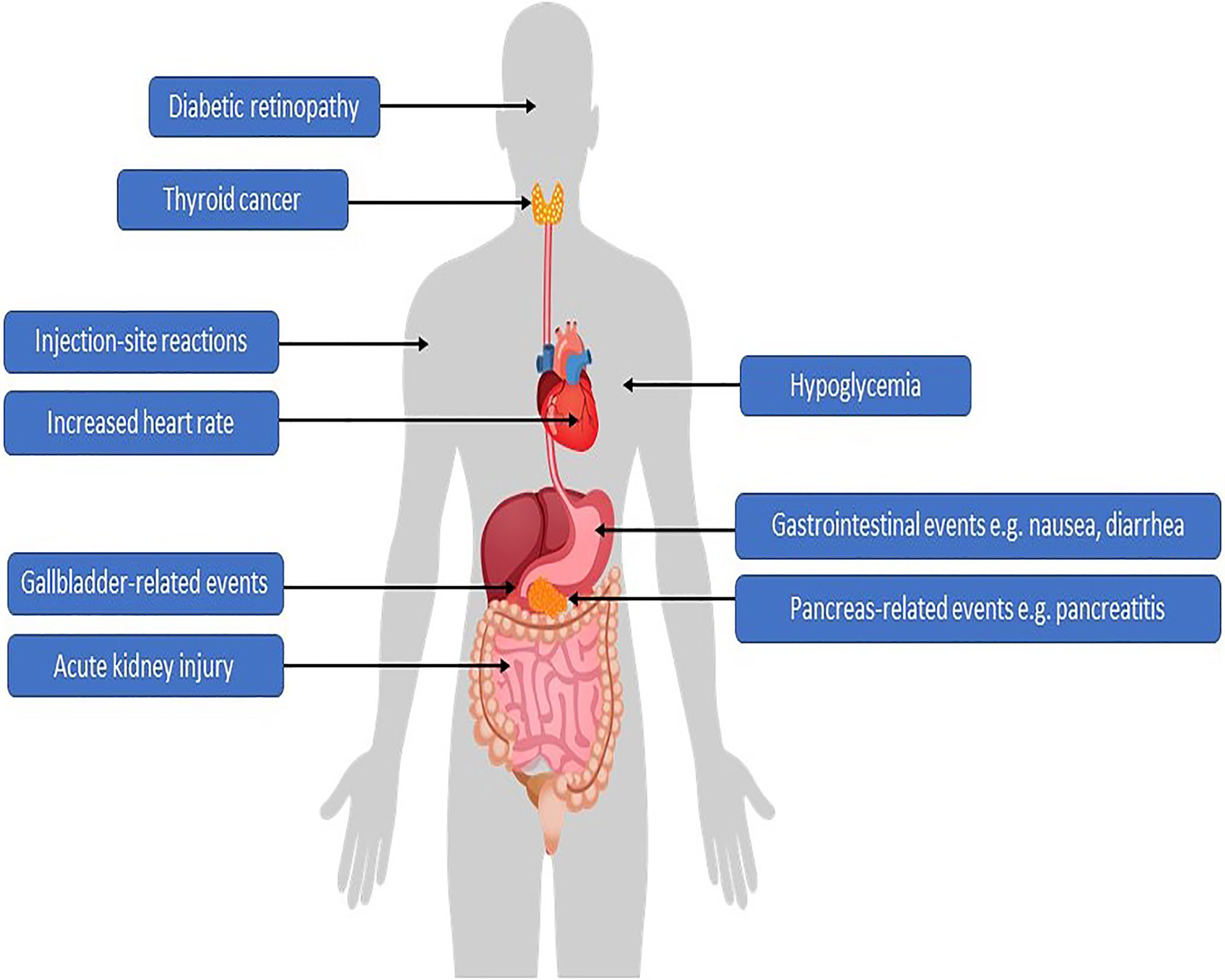

Semaglutide is a GLP-1 receptor agonist that works by mimicking the hormone GLP-1, which is involved in appetite regulation and glucose metabolism. This medication helps lower blood sugar levels and promotes feelings of fullness, leading to reduced caloric intake and weight loss. Approved by the NHS for use in managing obesity, Semaglutide is an important tool in the fight against obesity-related health conditions, including cardiovascular diseases and type 2 diabetes.

The Importance of Insurance Coverage

Insurance coverage is crucial for accessing necessary medications. The cost of Semaglutide can be significant, with monthly prices reaching hundreds of pounds. Without adequate insurance, many patients may find it difficult to afford this medication. Understanding how insurance providers view Semaglutide can help patients navigate their treatment options and make informed decisions regarding their health.

Types of Insurance Coverage for Semaglutide

National Health Service (NHS) Coverage

In the UK, Semaglutide may be covered under the NHS for eligible patients. The NHS provides coverage for medications that are deemed clinically effective and cost-effective. To qualify for NHS coverage, patients typically need to meet specific criteria, which may include:

- A BMI (Body Mass Index) of 30 or higher.

- A BMI of 27 or higher with obesity-related health issues such as diabetes or hypertension.

- Previous unsuccessful attempts at weight loss through lifestyle changes.

Patients should consult their healthcare provider to determine if they meet the eligibility criteria for NHS coverage. If approved, Semaglutide can be prescribed at a significantly reduced cost, making it more accessible for patients.

Private Insurance Coverage

For those who do not qualify for NHS coverage or prefer to explore private options, private health insurance may provide coverage for Semaglutide. However, the extent of coverage can vary widely between insurance providers. Some key points to consider include:

- Policy Details: Patients should carefully review their insurance policy to understand what is covered. Some plans may cover the medication but require prior authorization, while others may exclude it altogether.

- Co-Payments and Deductibles: Even with insurance, patients may be responsible for co-payments or deductibles, which can impact the overall cost.

- Pre-Existing Conditions: Insurance providers may have specific policies regarding pre-existing conditions, which can affect coverage for Semaglutide.

Cost Considerations

Out-of-Pocket Expenses

For patients without insurance or those whose insurance does not cover Semaglutide, the out-of-pocket cost can be substantial. Prices for a month’s supply can range from £150 to over £300, depending on the pharmacy and the formulation. This financial burden can deter individuals from pursuing effective treatment.

Potential Financial Assistance

Some pharmaceutical companies offer patient assistance programs that may help reduce costs for eligible individuals. These programs can provide financial support, discounts, or even free medications for those who qualify based on income and other factors. Patients should inquire with their healthcare provider or the medication’s manufacturer to explore available options.

Navigating the Insurance Process

Steps to Take

To successfully navigate the insurance process for Semaglutide, patients can take the following steps:

- Consult Healthcare Providers: Start by discussing the need for Semaglutide with a healthcare provider. They can provide guidance on whether the medication is appropriate and assist with the prescription process.

- Research Insurance Plans: Patients should familiarize themselves with their insurance plan’s coverage options. This includes checking whether Semaglutide is included in the formulary and understanding the requirements for prior authorization.

- Gather Necessary Documentation: Insurance providers may require specific documentation, such as medical records or proof of previous weight loss attempts, to approve coverage for Semaglutide. Patients should work with their healthcare providers to gather and submit this information promptly.

- Follow Up: After submitting the necessary documents, patients should follow up with their insurance provider to check on the status of their claim. This proactive approach can help prevent delays in obtaining the medication.

- Explore Alternatives: If insurance coverage is denied, patients can discuss alternative medications or treatment options with their healthcare provider. In some cases, lifestyle interventions may be recommended as a first-line approach before considering medications.

Conclusion

Navigating insurance coverage for Semaglutide can be challenging, but understanding the available options and processes can empower patients to make informed decisions about their health. By familiarizing themselves with NHS coverage criteria, private insurance policies, and potential financial assistance programs, patients can improve their chances of obtaining necessary treatment.

For those considering Semaglutide for weight management, it’s important to explore all available resources. Patients may want to consider their options for purchasing Semaglutide, including online sources. If you’re looking to buy Semaglutide UK, make sure to consult reputable pharmacies to ensure you are getting a legitimate product.

Moreover, for those interested in enhancing their fitness journey, there may be interest in related products. If you’re considering options to complement your health goals, you might also want to explore opportunities to buy steroids UK, keeping in mind the importance of safety and legality. For more information on various products and health enhancements, visit Hygetropin UK. Remember, it’s essential to prioritize your health and work closely with healthcare professionals when making decisions about treatment and medications.