In this comprehensive guide, we delve into the intricacies of deciphering a cash flow statement example. Understanding cash flow is crucial for any business, as it provides insights into the movement of funds within an organization. From investors to business owners, grasping the nuances of cash flow statements empowers decision-making and ensures financial stability.

Unraveling the Cash Flow Statement Example

What is a Cash Flow Statement?

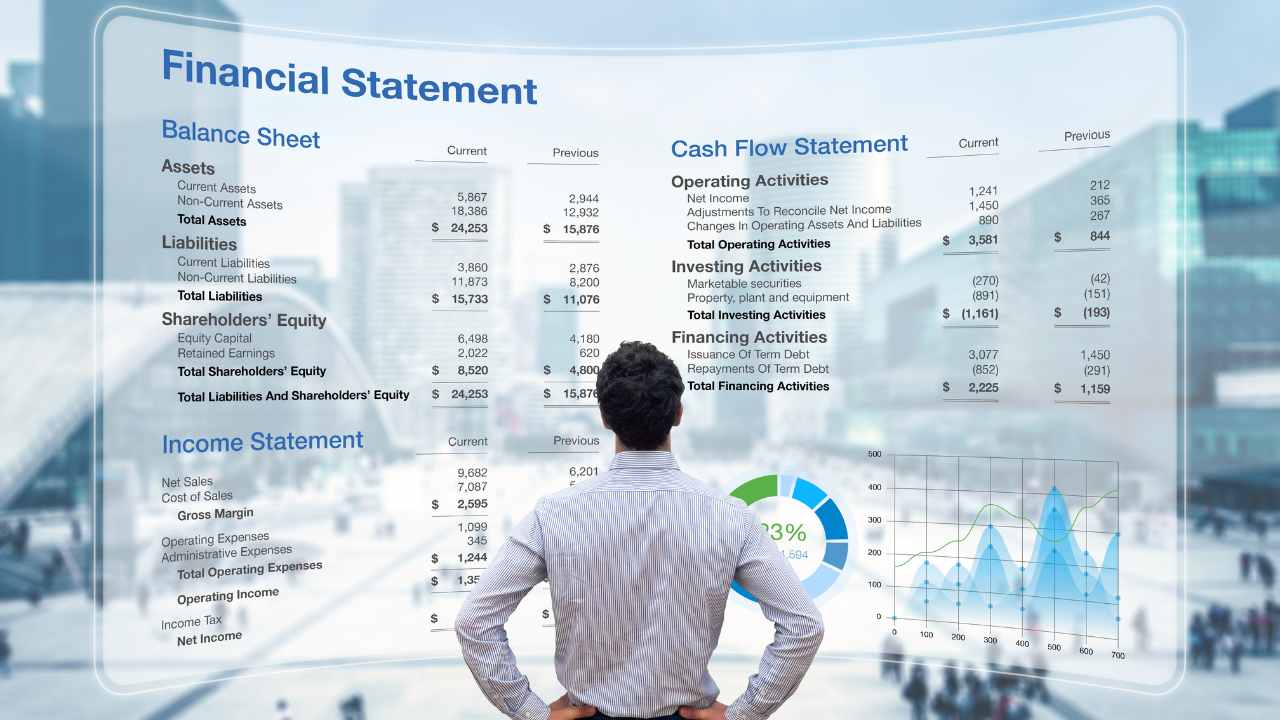

A cash flow statement is a financial document that tracks the inflow and outflow of cash within a business over a specific period. It consists of three main sections: operating activities, investing activities, and financing activities.

A cash flow statement example offers a snapshot of how cash moves in and out of a company, providing valuable insights into its liquidity and financial health.

Importance of Analyzing Cash Flow

Analyzing a cash flow statement example is crucial for several reasons. It helps businesses:

- Monitor Liquidity: By tracking cash inflows and outflows, companies can ensure they have enough liquid assets to meet their short-term obligations.

- Evaluate Financial Performance: Understanding cash flow patterns allows businesses to assess their financial performance and make informed decisions.

- Forecast Future Cash Needs: Analyzing past cash flow statements aids in forecasting future cash requirements, enabling proactive financial planning.

Components of a Cash Flow Statement

A typical cash flow statement example comprises three key sections:

- Operating Activities: This section includes cash transactions related to core business operations, such as revenue from sales and payments to suppliers.

- Investing Activities: Here, cash transactions involving the purchase and sale of long-term assets, such as property or equipment, are recorded.

- Financing Activities: This section tracks cash flows related to financing, such as issuing or repurchasing stock, as well as borrowing and repaying loans.

Analyzing a Cash Flow Statement Example

Deciphering a cash flow statement example requires a systematic approach. Here’s how to analyze it effectively:

Step 1: Examine Operating Activities

Begin by reviewing the operating activities section, which provides insights into the company’s core business operations. Look for trends in cash receipts and payments, focusing on factors impacting liquidity and profitability.

Step 2: Evaluate Investing Activities

Next, analyze the investing activities section to assess the company’s investment decisions. Identify cash flows related to asset acquisitions and disposals, evaluating their impact on long-term growth and profitability.

Step 3: Review Financing Activities

Finally, examine the financing activities section to understand how the company raises and repays capital. Evaluate cash flows from financing activities, such as debt issuance and dividend payments, to gauge the company’s financial stability and capital structure.

Advantages of Using a Cash Flow Statement Example

Understanding and utilizing a cash flow statement example offers several advantages:

- Enhanced Financial Decision-Making: By providing a clear picture of cash inflows and outflows, businesses can make informed financial decisions.

- Improved Cash Management: Analyzing cash flow statements helps businesses optimize cash flow, ensuring they have sufficient funds to meet their financial obligations.

- Increased Investor Confidence: Transparent cash flow reporting enhances investor confidence and fosters trust in the company’s financial management.

Frequently Asked Questions (FAQs)

- What is the Purpose of a Cash Flow Statement? The primary purpose of a cash flow statement is to provide insights into a company’s liquidity and financial health by tracking cash inflows and outflows.

- How Often Should a Cash Flow Statement be Prepared? Cash flow statements are typically prepared quarterly and annually, although some businesses may opt to generate them monthly for more frequent analysis.

- Can a Positive Cash Flow be Negative? While a positive cash flow is generally indicative of financial health, it’s essential to assess the quality and sustainability of cash flows to determine their true impact on the business.

- How Does Depreciation Affect Cash Flow? Depreciation is a non-cash expense that reduces net income but does not impact cash flow directly. However, it may influence tax liabilities and investment decisions.

- Why is Cash Flow Management Important for Small Businesses? Effective cash flow management is crucial for small businesses to ensure they can cover expenses, invest in growth opportunities, and weather financial challenges.

- What Are the Limitations of Cash Flow Statements? While cash flow statements provide valuable insights, they have limitations, such as not accounting for non-cash transactions and failing to capture future cash flows.

Conclusion

Mastering the art of analyzing a cash flow statement example is indispensable for businesses striving for financial success. By deciphering cash flow patterns and understanding their implications, companies can navigate economic uncertainties, make informed decisions, and foster sustainable growth.